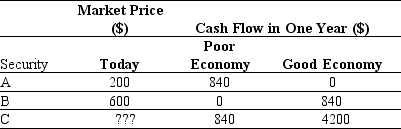

Use the table for the question(s) below.

-Suppose a risky security pays an average cash flow of $100 in one year.The risk-free rate is 5%,and the expected return on the market index is 13%.If the returns on this security are high when the economy is strong and low when the economy is weak,but the returns vary by only half as much as the market index,what risk premium is appropriate for this security?

Definitions:

Hedging

A risk management strategy used to limit or offset the probability of loss from fluctuations in the prices of commodities, currencies, or securities.

Closely Related

Closely Related describes items, individuals, or concepts that are closely connected in terms of characteristics, functions, or relationships.

Forward Contract

An agreement between two entities to purchase or sell a certain asset at a specified price and date in the future.

Wheat

Wheat is a staple grain that serves as a major food source globally, and it also plays a significant role in commodity trading markets.

Q1: How does a pyramid structure work?

Q1: Using the binomial pricing model, the calculated

Q8: Savings that come from combining the marketing

Q16: Consider the following equation: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2720/.jpg" alt="Consider

Q24: Treasury securities that are pure discount bonds

Q27: Which of the following statements is FALSE?<br>A)

Q35: Luther Industries does not pay dividend and

Q52: A mining company is offering to trade

Q54: Which of the following statements is FALSE

Q72: If the risk-free interest rate is 10%,