Use the table for the question(s) below.

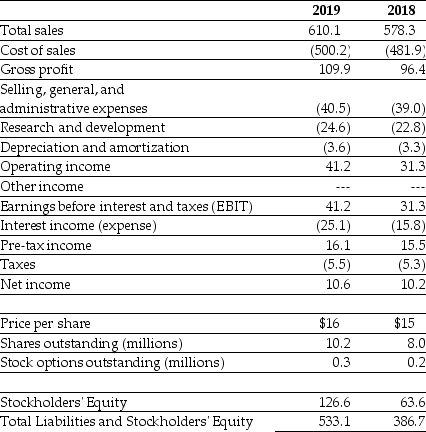

Consider the following income statement and other information:

Luther Corporation

Consolidated Income Statement

Year ended December 31 (in $ millions)

-Wyatt Oil has a net profit margin of 4.0%,a total asset turnover of 2.2,total assets of $525 million,and a book value of equity of $220 million.Wyatt Oil's current return-on-assets (ROA) is closest to:

Definitions:

Sustained Economic Growth

A prolonged period of increase in the goods and services produced by an economy, indicating health and prosperity.

Living Standards

A measure of the wealth, comfort, material goods, and necessities available to individuals or societies.

U.S. Investment

The activity of allocating resources, usually in the form of capital or money, into the United States' financial assets or business ventures with the expectation of achieving a profit.

Gross Savings

The total amount saved by an economy before accounting for depreciation.

Q7: Assume that Omicron uses the entire $50

Q9: With the proper changes it is believed

Q15: Which of the following questions regarding risk

Q18: Which of the following statements regarding leases

Q25: Assuming that Rearden's annual lease payments are

Q28: Your firm purchases goods from its supplier

Q33: The Sarbanes-Oxley Act (SOX) overhauled incentives and

Q59: If in 2009 Luther has 10.2 million

Q68: The date on which the board authorizes

Q92: The price per share of Iota if