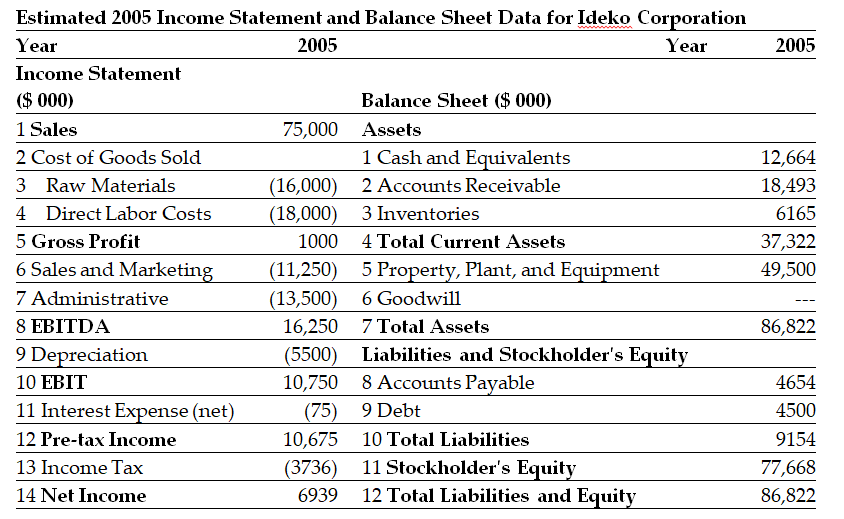

Use the tables for the question(s) below.

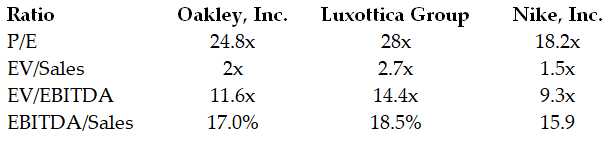

The following are financial ratios for three comparable companies:

-Based upon the average EV/EBITDA ratio of the comparable firms,if Ideko holds $6.5 million of cash in excess of its working capital needs,then Ideko's target market value of equity is closest to:

Definitions:

Realized Gains

Profits earned from the sale of assets or investments when they are actually sold, as opposed to when they increase in value on paper.

Amortized Cost

The initial measurement of a financial asset or liability, adjusted for repayments of principal, accumulation of interest, and any loss in value.

Interest Income

Interest income is the revenue earned from deposit accounts or investments through the lending of money or the use of capital.

Q4: Luther's return on equity (ROE) for the

Q9: Which of the following statements is FALSE?<br>A)

Q22: Consider the following formula: r<sub>wacc</sub> = <img

Q28: Luther Industries is currently trading for $27

Q29: Which of the following statements is FALSE?<br>A)

Q37: Assuming that Ideko has a EBITDA multiple

Q42: The lease rate for which Rearden will

Q50: Which of the following statements is FALSE?<br>A)

Q68: The NPV for Omicron's new project is

Q73: If Flagstaff currently maintains a .5 debt