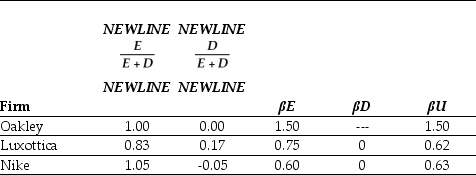

Use the table for the question(s) below.

Capital Structure and Unlevered Beta Estimates for Comparable Firms

-If the risk-free rate of interest is 6% and the market risk premium has historically averaged 5%,then the cost of capital for Luxottica is closest to:

Definitions:

Marginal Revenue Product

The additional revenue generated from employing one more unit of a resource, factor, or input.

Total Product

The overall quantity of output that a firm produces, usually within a given period, considering all factors of production.

Complementary Resources

Assets or inputs that enhance the value or effectiveness when used in conjunction with another resource.

Least-costly Combination

In production, using the mix of resources that minimizes cost while producing a given level of output.

Q5: Assuming that Rearden's annual lease payments are

Q21: Perrigo's market capitalization is closest to:<br>A) $952.16

Q36: If you take the job with Wyatt

Q39: Which of the following statements is FALSE?<br>A)

Q41: Luther's Accounts Payable days is closest to:<br>A)

Q43: Which of the following statements is FALSE?<br>A)

Q50: Which of the following is NOT one

Q53: Which of the following statements is FALSE?<br>A)

Q56: Assume that Rockwood is not able to

Q86: Sisyphean Bolder Movers Incorporated has no debt,