Use the following information to answer the question(s) below.

d'Anconia Copper has $200 million in cash that it can use for a share repurchase. Suppose instead that d'Anconia Copper invests the funds in an account paying 5% interest for one year. Assume that the corporate tax rate is 35%, the individual capital gains rate is 15% and the individual rate on ordinary income is 30%.

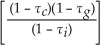

-Consider the following equation: Pretain = Pcum ×  The term τi in this equation represents:

The term τi in this equation represents:

Definitions:

Sternal Notch

The visible dip at the top of the sternum between where the collarbones meet at the base of the neck.

Tracheostomy Tube

A tube inserted through a surgically created hole in the front of the neck and into the trachea to aid in breathing.

Hyperoxygenating

The process of increasing the amount of oxygen in the blood or tissues, often used in medical treatments to enhance oxygenation in patients.

Negative Pressure

A condition in which the pressure in a given environment is lower than the atmospheric pressure, typically used in medical settings to contain airborne contaminants.

Q19: Assuming that this is the venture capitalist's

Q54: Wyatt Oil has a bond issue outstanding

Q57: Assume that MM's perfect capital markets conditions

Q58: In order for Nielson Motor's to be

Q59: Given that Rose issues new debt of

Q69: If Luther's accounts receivable were $55.5 million

Q71: The WACC for this project is closest

Q79: The weighted average cost of capital for

Q83: Which of the following is NOT a

Q95: Wyatt Oil's average historical return is closest