Use the information for the question(s)below.

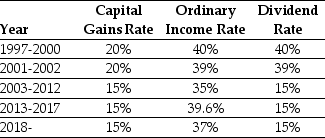

Consider the following tax rates:  *The current tax rates are set to expire after 2025 unless Congress extends them.The tax rates shown are for financial assets held for one year.For assets held less than one year,capital gains are taxed at the ordinary income tax rate (currently 37% for the highest bracket);the same is true for dividends if the assets are held for less than 61 days.

*The current tax rates are set to expire after 2025 unless Congress extends them.The tax rates shown are for financial assets held for one year.For assets held less than one year,capital gains are taxed at the ordinary income tax rate (currently 37% for the highest bracket);the same is true for dividends if the assets are held for less than 61 days.

-Using the available tax information for 2002,calculate the effective dividend tax rate for a:

(1)one-year individual investor

(2)buy and hold individual investor

(3)pension fund

Definitions:

Blood-Brain Barrier

A selective barrier that prevents certain substances from entering the brain from the blood.

Autonomic Nervous System

The part of the nervous system that controls involuntary actions of the body, such as heart rate and digestion.

Motor Fibers

Nerve fibers that transmit impulses from the nervous system to muscles, causing them to contract.

Cardiac Muscles

Specialized muscle tissue found only in the heart, responsible for the heart's contraction and blood circulation.

Q3: Which of the following statements is FALSE?<br>A)

Q7: Assuming that Ideko has a EBITDA multiple

Q21: With perfect capital markets, what is the

Q22: Suppose that the managers at Rearden Metal

Q32: Nielson Motors plans to issue 10-year bonds

Q45: The weight on Wyatt Oil stock in

Q55: If Wyatt Oil distributes the $70 million

Q84: Galt's asset beta (ie the beta of

Q85: Suppose that MI has zero-coupon debt with

Q108: Taggart Transcontinental has a value of $500