Use the following information to answer the question(s) below.

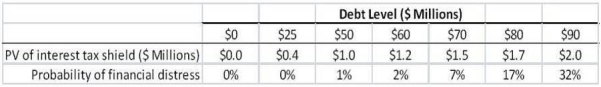

d'Anconia Copper is considering issuing one-year debt,and has come up with the following estimates of the value of the interest tax shield and the probability of distress for different levels of debt:

-If in the event of distress,the present value of distress costs is equal to $25 million,then the optimal level of debt for d'Anconia Copper is:

Definitions:

Supply Curve

A graphical representation that shows the relationship between the price of a good and the quantity of the good that suppliers are willing and able to produce and sell.

Total Variable Costs

The overall expense that changes in proportion to the level of output or production activity.

Output

The total amount of goods or services produced by a company, industry, or economy within a specific period.

Supply Curve

A graphical representation showing the relationship between the price of a good or service and the quantity of that good or service that a supplier is willing and able to supply.

Q9: Which of the following statements is FALSE?<br>A)

Q14: The Dodd-Frank Wall Street Reform and Consumer

Q27: The unlevered beta for Oakley is closest

Q52: Your estimate of the debt beta for

Q57: Consider the following equation: P<sub>retain</sub> = P<sub>cum</sub>

Q67: The value of Shepard Industries with leverage

Q72: The alpha that investors in Galt's fund

Q80: Calculate the NPV for Iota's new project.

Q81: If Wyatt Oil distributes the $70 million

Q110: Which of the following statements is FALSE?<br>A)