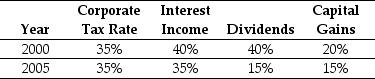

Use the table for the question(s) below.

Consider the following historical top federal tax rates in the United States:

Personal Tax Rates

-In 2000,assuming an average dividend payout ratio of 50%,the effective tax rate for equity holders was closest to:

Definitions:

Emotional Support

Concern for others’ well-being and support of their decisions in a job setting.

Employee Turnover

The rate at which employees leave a company and are replaced by new employees, affecting a company's stability and continuity.

Fast-Food Restaurants

Eateries that serve quick, easily accessible, and inexpensive food, often through counter service or drive-thru.

Empowerment

The process of increasing the capacity of individuals or groups to make choices and transform those choices into desired actions and outcomes.

Q8: A member of Iota's board of directors

Q21: The effective dividend tax rate in 1999

Q35: If Ideko's future expected growth rate is

Q44: Which of the following adjustments is NOT

Q72: If you are interested in creating a

Q73: Which of the following statements is FALSE?<br>A)

Q76: Which firm has the highest cost of

Q88: Consider a portfolio that consists of an

Q88: Merck's market capitalization is closest to:<br>A) $38.2

Q95: The term moral hazard refers to:<br>A) the