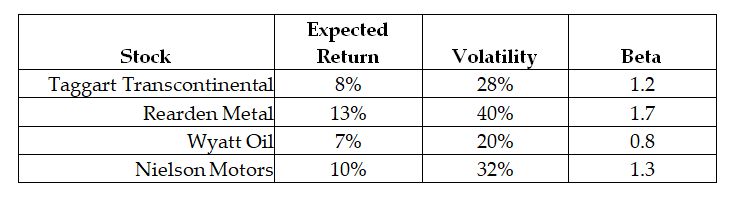

Use the following information to answer the question(s) below.

Assume that the CAPM is a good description of stock price returns. The market expected return is 8% with 12% volatility and the risk-free rate is 3%. New information arrives that does not change any of these numbers, but it does change the expected returns of the following stocks:

-Which of the following stocks represent selling opportunities?

1.Taggart Transcontinental

2.Rearden Metal

3.Wyatt Oil

4.Nielson Motors

Definitions:

Nearsightedness

A vision condition where close objects are seen clearly, but distant ones are blurred.

Alcohol

A chemical compound commonly found in beverages such as beer, wine, and spirits, known for its psychoactive effects.

Omnipotent

Possessing unlimited power and able to do anything.

Stem Cells

Undifferentiated biological cells that can differentiate into specialized cells and can divide to produce more stem cells.

Q17: Rearden's NPV for purchasing this policy is

Q23: You own 100 shares of a Sub

Q25: Consider the following equation: S × <img

Q29: Which of the following equations is INCORRECT?<br>A)

Q32: Consider the following equation: E + D

Q35: The expected return of a portfolio that

Q50: Using the data provided in the table,

Q56: The standard deviation of the overall payoff

Q74: Which of the following statements regarding portfolio

Q81: The beta for Sisyphean's new project is