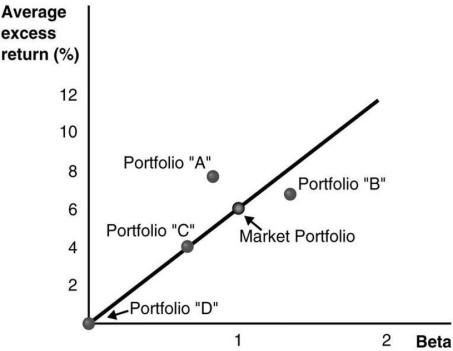

Use the figure for the question(s) below.Consider the following graph of the security market line:

-Which of the following statements regarding portfolio "B" is/are correct? 1.Portfolio "B" has a positive alpha.

2.Portfolio "B" is overpriced.

3.Portfolio "B" is less risky than the market portfolio.

4.Portfolio "B" should not exist if the market portfolio is efficient.

Definitions:

Schizophrenia

A severe mental disorder characterized by distortions in thinking, perception, emotions, language, sense of self, and behavior.

DSM

Diagnostic and Statistical Manual of Mental Disorders; a manual published by the American Psychiatric Association that categorizes and defines mental disorders.

Overdiagnosis

The diagnosis of a disease or condition that is unlikely to cause harm during a person's lifetime, leading to unnecessary treatment and anxiety.

Diagnostic Labels

Terms or phrases used by healthcare professionals to identify and classify mental health disorders or medical conditions.

Q2: If investors have relative wealth concerns, they

Q5: Suppose that you want to use the

Q18: The value of Luther with leverage is

Q36: Portfolio "B":<br>A) is less risky than the

Q65: Suppose that you want to maximize your

Q72: Which stock has the highest total risk?<br>A)

Q79: Consider the following equation: P<sub>retain</sub> = P<sub>cum</sub>

Q89: The Market's average historical excess return is

Q91: Assuming that to fund the investment Taggart

Q118: California Gold Mining's beta with the market