Use the following information to answer the question(s) below.

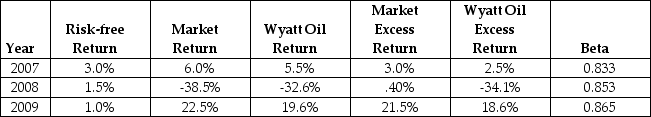

-Using the average historical excess returns for both Wyatt Oil and the Market portfolio,your estimate of Wyatt Oil's Beta is closest to:

Definitions:

Performance Measures

Metrics and indicators used to evaluate and assess the effectiveness, efficiency, and success of an organization's activities and employees.

Planning And Control System

A framework used by organizations to align their strategic objectives with practical actions, monitor performance, and manage resources.

Flatter Structure

This refers to an organizational design with fewer layers of management and a wider span of control, aimed at improving communication and decision-making efficiency.

Levels Of Management

The hierarchy of authority within an organization, classifying the different layers of management from top to operational level.

Q1: Luther's weighted average cost of capital is

Q18: The volatility of a portfolio that is

Q27: Which of the following are subject to

Q28: Which of the following statements is FALSE?<br>A)Corporations

Q36: Which of the following statements is FALSE?<br>A)

Q64: Which of the following industries is likely

Q70: Suppose that Luther's beta is 0.9. If

Q77: What is the expected payoff to debt

Q87: Which stock has the highest systematic risk?<br>A)

Q101: Suppose that MI has zero-coupon debt with