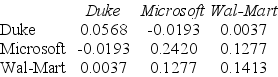

Use the table for the question(s) below.

Consider the following covariances between securities:

-Which of the following formulas is INCORRECT?

Definitions:

Duration

The measure of the sensitivity of the price of a bond or other debt instrument to changes in interest rates, often expressed in years.

Coupon Bond

A type of bond that pays the holder interest payments at fixed intervals (usually annually or semi-annually) until the bond matures, at which point the principal amount is repaid.

Interest-Rate Risk

The potential for investment losses that result from a change in interest rates, affecting the value of fixed-income securities inversely.

Yield To Maturity

The total return anticipated on a bond if the bond is held until its maturation date, accounting for interest payments and the difference between purchase price and par value.

Q1: If shareholders are unhappy with a CEO's

Q11: Two separate firms are considering investing in

Q19: If you buy shares of Coca-Cola on

Q26: What is the overall expected payoff under

Q26: Suppose that KAN's beta is 1.5. If

Q36: Which of the following statements is FALSE?<br>A)

Q59: Assume that you have $100,000 to invest

Q73: What alternative investment has the highest possible

Q83: Which firm has the most total risk?<br>A)

Q95: Which of the following statements is FALSE?<br>A)