Use the table for the question(s) below.

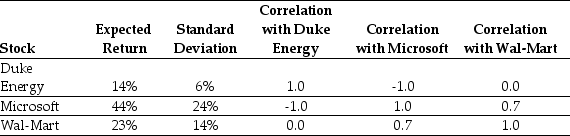

Consider the following expected returns,volatilities,and correlations:

-Consider a portfolio consisting of only Duke Energy and Microsoft.The percentage of your investment (portfolio weight) that you would place in Duke Energy stock to achieve a risk-free investment would be closest to:

Definitions:

Markup

An additional amount incorporated into the buying price of products to compensate for running expenses and gain profit.

Selling Price

The amount of money for which a product or service is sold to the buyer.

Markdown Percentage

The reduction percentage applied to an item's retail price to stimulate sales or clear out inventory.

Hand-painted Stemware

Glassware for drinks that has been decorated by hand with paint, often featuring intricate designs or patterns.

Q1: The term 2/10 net 30 means:<br>A)If the

Q9: If the risk-free rate is 3% and

Q23: Which of the following statements is FALSE?<br>A)When

Q25: The expected return for Rearden Metal is

Q27: The variance on a portfolio that is

Q28: Which of the following statements is FALSE?<br>A)

Q42: Your firm currently has $250 million in

Q46: Which of the following statements is FALSE?<br>A)Financing

Q50: The term <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2720/.jpg" alt="The term

Q70: If it is managed efficiently, then the