Use the following information to answer the question(s) below.

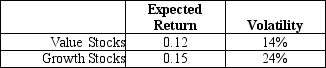

Suppose that all stocks can be grouped into two mutually exclusive portfolios (with each stock appearing in only one portfolio) : growth stocks and value stocks.Assume that these two portfolios are equal in size (market value) ,the correlation of their returns is equal to 0.6,and the portfolios have the following characteristics:  The risk-free rate is 3.5%.

The risk-free rate is 3.5%.

-The expected return on the market portfolio (which is a 50-50 combination of the value and growth portfolios) is closest to:

Definitions:

Pull Strategy

A marketing approach that focuses on creating demand for a product or service, encouraging consumers to actively seek it out.

Q8: Which of the following statements is FALSE?<br>A)The

Q10: How much would you receive if you

Q15: Portfolio "C":<br>A) is less risky than the

Q30: Various trading strategies appear to offer non-zero

Q45: The total of Rosewood's net income and

Q55: A type of agency problem that results

Q57: Assume that MM's perfect capital markets conditions

Q61: The idea that managers who perceive the

Q132: Suppose over the next year Ball has

Q133: Which of the following statements is FALSE?<br>A)