Use the following information to answer the question(s) below.

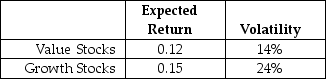

Suppose that all stocks can be grouped into two mutually exclusive portfolios (with each stock appearing in only one portfolio) : growth stocks and value stocks.Assume that these two portfolios are equal in size (market value) ,the correlation of their returns is equal to 0.6,and the portfolios have the following characteristics:  The risk free rate is 3.5%.

The risk free rate is 3.5%.

-The Sharpe ratio for the market (which is a 50-50 combination of the value and growth portfolios) portfolio is closest to:

Definitions:

Aggregate Demand Curve

represents the total demand for all goods and services in an economy at different price levels, typically downward sloping.

Prices

The amount of money required to purchase goods or services, representing the value placed on those items.

Wages

Payments made to employees for their labor, typically calculated on an hourly, daily, or piece rate basis, as compensation for work performed.

Recognition Lag

The time delay between when an economic problem or trend occurs and when it is recognized by policymakers or economists.

Q11: Suppose over the next year Ball has

Q21: Which of the following is NOT considered

Q23: If Rockwood finances their expansion by issuing

Q25: The effective annual rate for Taggart if

Q34: Which of the following is NOT a

Q42: Which of the following statements is FALSE?<br>A)If

Q56: At the conclusion of this transaction, the

Q60: Which of the following firms is likely

Q81: Which of the following statements is FALSE?<br>A)

Q98: Assume that in addition to 1.25 billion