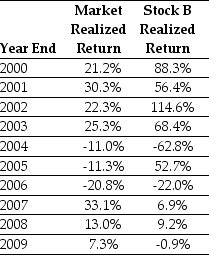

Use the table for the question(s)below.

Consider the following realized annual returns:

-Suppose that you want to use the 10 year historical average return on Stock B to forecast the expected future return on Stock B.Calculate the 95% confidence interval for your estimate of the expect return.

Definitions:

Oil

A fossil fuel that is used primarily for energy production and as a raw material in the manufacturing of plastics and other chemicals.

Domestic Quantity

The total amount of a good or service produced within a country's borders and available for consumption or sale in the domestic market.

Supplied

Refers to the amount of a good or service that producers are willing and able to sell at a given price.

U.S. Tariff

Taxes imposed by the United States government on imported goods to protect domestic industries or to generate revenue.

Q4: Which of the following statements is FALSE?<br>A)

Q5: Which of the following statements is FALSE?<br>A)

Q14: If Ford Motor Company bought The Goodyear

Q29: In December 2005, the spot exchange rate

Q44: If Rearden offers an exchange ratio such

Q45: The temporary working capital needs for Hasbeen

Q56: At the conclusion of this transaction, the

Q64: What is the excess return for the

Q84: Which of the following statements is FALSE?<br>A)

Q89: Assume that MM's perfect capital markets conditions