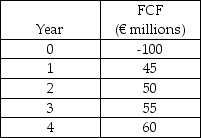

Use the following information to answer the question(s) below.

Hammond Motors is considering an investment in the Euro area.The expected free cash flows,in euros,are uncorrelated with the spot exchange rate and are as follows:  The new project,which Hammond is considering,has similar dollar risk to Hammond's other projects.Hammond knows that its overall dollar WACC is 10%,so it feels comfortable using this WACC for the project.The risk-free interest rate on dollars is 4% and the risk-free interest rate on euros is 6%.Hammond is willing to assume that capital markets in the United States and the Euro area are internationally integrated.

The new project,which Hammond is considering,has similar dollar risk to Hammond's other projects.Hammond knows that its overall dollar WACC is 10%,so it feels comfortable using this WACC for the project.The risk-free interest rate on dollars is 4% and the risk-free interest rate on euros is 6%.Hammond is willing to assume that capital markets in the United States and the Euro area are internationally integrated.

-Hammond's Euro WACC is closest to:

Definitions:

Niche Strategy

A focused marketing approach targeting a specific, well-defined segment of the market, often with specialized products or services.

Product Differentiation

The method of making a product or service stand out from the competition in order to appeal more to a specific target group.

Narrow Market

A market segment characterized by a specific and often limited customer base, interests, or area of focus.

Cost Leadership

A competitive strategy where a company aims to become the lowest-cost producer in its industry or market.

Q6: Which of the following statements is FALSE?<br>A)

Q7: Hammond's cash conversion cycle in 2009 is

Q20: A rights offering that gives existing target

Q20: Suppose that you borrow only $45,000 in

Q27: Assuming that this is the venture capitalist's

Q29: Prior to any borrowing and share repurchase,

Q47: The standard deviation of the overall payoff

Q50: This period is known for hostile, "bust-up"

Q69: Which of the following statements is FALSE?<br>A)

Q74: Which of the following statements is FALSE?<br>A)