Use the information for the question(s)below.

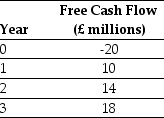

Luther Industries,a U.S.Corporation,is considering a new project located in Great Britain.The expected free cash flows from the project are detailed below:  You know that the spot exchange rate is S = 1.8862/£.In addition,the risk-free interest rate on dollars and pounds is 5.4% and 4.6% respectively.Assume that these markets are internationally integrated and the uncertainty in the free cash flow is not correlated with uncertainty in the exchange rate.You have determined that the dollar WACC for these cash flows is 10.2%.

You know that the spot exchange rate is S = 1.8862/£.In addition,the risk-free interest rate on dollars and pounds is 5.4% and 4.6% respectively.Assume that these markets are internationally integrated and the uncertainty in the free cash flow is not correlated with uncertainty in the exchange rate.You have determined that the dollar WACC for these cash flows is 10.2%.

-Calculate the pound denominated cost of capital for Luther's project.

Definitions:

Inventory

The goods and materials a business holds for the ultimate purpose of resale or processing.

Perpetual Inventory System

An accounting method that records the sale or purchase of inventory immediately through the use of computerized point-of-sale systems and enterprise asset management software.

FIFO Method

An inventory valuation method where the first goods purchased are the first ones to be sold, "First In, First Out".

Days In Inventory

Days in inventory is a financial metric indicating how long it takes for a company to turn its inventory into sales.

Q5: Which of the following statements is FALSE?<br>A)

Q17: Which of the following statements is FALSE?<br>A)In

Q19: The permanent working capital needs for Hasbeen

Q20: The post-money valuation of your firm is

Q30: Various trading strategies appear to offer non-zero

Q35: An extremely lucrative severance package that is

Q51: The proceeds from the IPO be if

Q51: What is the Yield to Call (YTC)on

Q84: The variance of the return on Alpha

Q94: What is the excess return for corporate