Use the following information to answer the question(s) below.

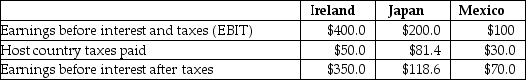

Incorporated Tool,a U.S.firm,is considering its international tax situation.The corporate tax rate in the U.S.is currently 39%.Incorporated Tool has major operations in Ireland,where the tax rate is 12.5%,Japan where the tax rate is 40.7%,and Mexico,where the tax rate is 30.0%.Incorporated Tool's profits,which are fully and immediately repatriated,and foreign taxes paid for the current year are as follows:

-Assuming that the Japanese and Mexican subsidiaries did not exist,the U.S.tax liability on the Irish subsidiary would be closest to:

Definitions:

Range Finder

A device or tool used to measure the distance from the observer to a target, commonly used in photography, golf, and surveying.

Cell References

Indicators that point to specific cells in a spreadsheet, used for calculations or to display their contents.

Formula

A mathematical or logical expression entered into a spreadsheet or software that performs calculations based on specified inputs or data.

Format Cells Dialog Box Launcher

A tool in spreadsheet software that opens a dialog box for adjusting the presentation of cell contents, including their format, style, and appearance.

Q13: After the Japanese taxes are paid, the

Q14: A _ is when a rich individual

Q14: Luther Industries is offered a $1 million

Q21: The covariance between Stock X's and Stock

Q23: Which of the following statements regarding commercial

Q25: The effective annual rate for Taggart if

Q27: Treasury securities that are semiannual-paying coupon bonds

Q35: Which of the following money market investments

Q38: Assume that you are an investor with

Q51: Which of the following statements regarding poison