Use the following information to answer the question(s) below.

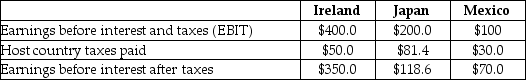

Incorporated Tool,a U.S.firm,is considering its international tax situation.The corporate tax rate in the United States is currently 21%.Incorporated Tool has major operations in Ireland,where the tax rate is 12.5%,Japan where the tax rate is 40.7%,and Mexico,where the tax rate is 30.0%.Incorporated Tool's profits,which are fully and immediately repatriated,and foreign taxes paid for the current year are as follows:

-Assuming that the Irish and Mexican subsidiaries did not exist,the U.S.tax liability on the Japanese subsidiary would be closest to:

Definitions:

United States

A country located in North America, known for its influential economy, diverse culture, and democratic government system.

Advertising

Advertising is the act of promoting products, services, or brands through different media to increase awareness, interest, and sales.

Children

Young human beings below the age of puberty or below the legal age of majority.

Q3: Assuming that this project will provide Rearden

Q15: Which of the following statements regarding currency

Q39: Consider the following equation: S × <img

Q46: Which of the following statements is FALSE?<br>A)

Q57: Suppose an investment is equally likely to

Q61: The market value for Chihuahua is closest

Q85: Which of the following statements is FALSE?<br>A)

Q97: Which of the following formulas is INCORRECT?<br>A)

Q99: Which of the following statements is FALSE?<br>A)

Q113: Which of the following statements is FALSE?<br>A)