Use the following information to answer the question(s) below.

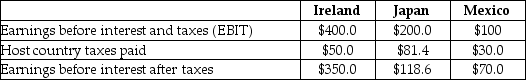

Incorporated Tool,a U.S.firm,is considering its international tax situation.The corporate tax rate in the United States is currently 21%.Incorporated Tool has major operations in Ireland,where the tax rate is 12.5%,Japan where the tax rate is 40.7%,and Mexico,where the tax rate is 30.0%.Incorporated Tool's profits,which are fully and immediately repatriated,and foreign taxes paid for the current year are as follows:

-Assuming that the Irish and Japanese subsidiaries did not exist,the U.S.tax liability on the Mexican subsidiary would be closest to:

Definitions:

Lesbians

Women who are romantically and sexually attracted to other women.

Reproductive Technologies

Medical techniques used to assist individuals in achieving pregnancy, such as in vitro fertilization, and technologies affecting reproductive choices.

George Annas

An American bioethicist well-known for his work on human rights in healthcare and medical ethics.

Right of Privacy

The entitlement to personal privacy and autonomy, free from unauthorized intrusion or disclosure.

Q5: Rearden Metal has just issued a callable,

Q7: Galt Industries has just issued a callable,

Q9: Firms should adjust for execution risk by:<br>A)

Q10: Which of the following statements is FALSE?<br>A)The

Q10: Which of the following statements is FALSE?<br>A)Recently,

Q15: Consider the following equation: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2790/.jpg" alt="Consider

Q31: Which of the following statements is FALSE?<br>A)New

Q46: Which of the following statements is FALSE?<br>A)

Q48: Which of the following questions regarding risk

Q129: Calculate the variance on a portfolio that