Use the information for the question(s)below.

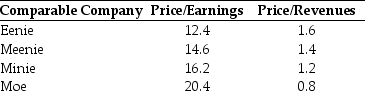

During the most recent fiscal year,KD Industries had revenues of $400 million and earnings of $30 million.KD has filed a registration statement with the SEC for its IPO.Before it is offered,KD's investment bankers would like to estimate the value of the company using comparable companies.The investment bankers have assembled the following information based on data for other companies in the same industry that have recently gone public.In each case,the ratios are based upon the IPO price.

-Based upon the price/earnings ratio,what would be a reasonable value for KD?

Definitions:

Equilibrium

In economics and finance, a state where supply equals demand, and market forces are in balance, resulting in stable prices.

WEBS Portfolios

WEBS Portfolios, originally known as World Equity Benchmark Shares, are exchange-traded funds that track international stock market indexes.

Passively Managed

An investment strategy that involves mimicking the performance of a market index, typically resulting in lower fees and turnover rates compared to active management.

Brokerage Commissions

Brokerage commissions are fees charged by a broker for executing transactions or providing specialized services.

Q2: Wyatt Oil purchases goods from its suppliers

Q13: Which of the following statements is FALSE?<br>A)Although

Q23: Which of the following statements is FALSE?<br>A)When

Q30: List five general categories of indirect costs

Q39: Assuming Luther issues a 25% stock dividend,

Q40: Luther Industries is offered a $1 million

Q42: Assuming that Ideko has a EBITDA multiple

Q42: Which of the following statements is FALSE?<br>A)If

Q79: Suppose that Gold Digger's beta is -0.8.

Q82: Because debtor-in-possession (DIP)financing is senior to all