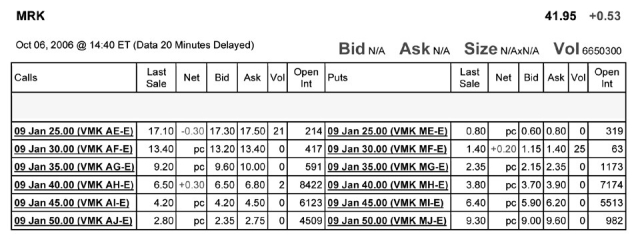

Use the table for the question(s)below.

Consider the following information on options from the CBOE for Merck:

-You have decided to sell (write)5 January 2009 put options on Merck with an exercise price of $45 per share.How much money will you receive and are these contracts in or out of the money?

Definitions:

Lost Profits

Financial losses incurred due to the interruption of normal business operations or activities, often recovered through legal claims.

Alternative Provision

A term often used in education, referring to different educational settings or programs provided for students who are unable to thrive in a conventional school environment.

Bush Pilot

A pilot who operates aircraft in remote, undeveloped regions, often dealing with challenging terrain and unimproved airstrips.

Helicopter

A type of rotorcraft in which lift and thrust are supplied by rotors, allowing it to take off and land vertically, hover, and fly forward, backward, and laterally.

Q1: Based upon the average EV/Sales ratio of

Q20: Using risk neutral probabilities, calculate the price

Q23: Which of the following is NOT a

Q40: KT corporation has announced plans to acquire

Q48: The duration of a five-year bond with

Q52: Given that Rose issues new debt of

Q53: Which of the following statements regarding recapitalization

Q57: The total debt overhang associated with accepting

Q71: The Debt Capacity for Omicron's new project

Q109: The number of new shares that Kinston