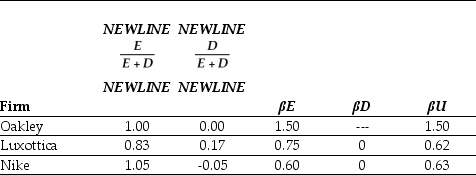

Use the table for the question(s) below.

Capital Structure and Unlevered Beta Estimates for Comparable Firms

-If the risk-free rate of interest is 6% and the market risk premium has historically averaged 5%,then the cost of capital for Nike is closest to:

Definitions:

False Alarm

A situation where a warning or alert is given, but no actual threat or danger exists.

Correct Rejection

In signal detection theory, the decision that a signal is not present when it truly is absent.

Hit

In cognitive psychology, correctly identifying a stimulus from a set of alternatives in memory tasks; in sports, making successful contact with the target.

Just Noticeable Difference

The minimal change in stimulus intensity required to detect a difference between two stimuli, according to psychophysical research.

Q3: Suppose that the managers at Rearden Metal

Q4: Galt Industries has issued four-month commercial paper

Q18: Assume that Omicron uses the entire $50

Q30: The amount of money raised by the

Q34: In order for Nielson Motor's to be

Q39: Which of the following statements is FALSE?<br>A)The

Q42: Assuming that Ideko has a EBITDA multiple

Q43: Which of the following is an example

Q60: The value of Galt's equity using the

Q62: Which of the following statements is FALSE?<br>A)The