Use the information for the question(s)below.

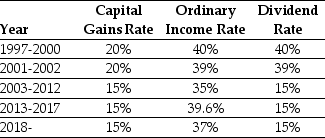

Consider the following tax rates:  *The current tax rates are set to expire after 2025 unless Congress extends them.The tax rates shown are for financial assets held for one year.For assets held less than one year,capital gains are taxed at the ordinary income tax rate (currently 37% for the highest bracket);the same is true for dividends if the assets are held for less than 61 days.

*The current tax rates are set to expire after 2025 unless Congress extends them.The tax rates shown are for financial assets held for one year.For assets held less than one year,capital gains are taxed at the ordinary income tax rate (currently 37% for the highest bracket);the same is true for dividends if the assets are held for less than 61 days.

-Using the available tax information for 2002,calculate the effective dividend tax rate for a:

(1)one-year individual investor

(2)buy and hold individual investor

(3)pension fund

Definitions:

Conglomerate Company

A large corporation that owns a diversified group of other companies across various industries, with no single business dominating its portfolio.

Minority-Owned

Refers to a business that is at least 51% owned, controlled, and operated by individuals from a recognized minority group.

Small Businesses

Independent enterprises with limited size and revenue, characterized by fewer employees and lesser market share compared to larger companies.

Home-Based Businesses

Enterprises operated from the owner’s home, utilizing minimal resources for managing business activities.

Q5: If KT expects to maintain a debt

Q7: Using the binomial pricing model, calculate the

Q23: Taggart Transcontinental has a value of $500

Q23: Assume that Omicron uses the entire $50

Q29: Using the binomial pricing model, the calculated

Q35: MJ Enterprises has 50 million shares outstanding

Q47: Bonds issued by a local entity, denominated

Q52: After the recapitalization, the total value of

Q72: Which of the following industries is likely

Q92: The unlevered beta for Nod is closest