Use the following information to answer the question(s) below.

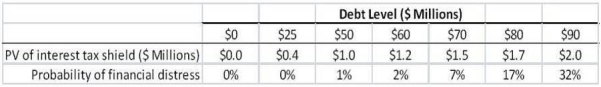

d'Anconia Copper is considering issuing one-year debt,and has come up with the following estimates of the value of the interest tax shield and the probability of distress for different levels of debt:

-If in the event of distress,the present value of distress costs is equal to $10 million,then the optimal level of debt for d'Anconia Copper is:

Definitions:

Crisis Situations

Events or periods characterized by sudden, severe problems or dangers that require immediate action to prevent or mitigate negative outcomes.

Common Set Of Boundaries

Established limits or guidelines within which individuals are expected to operate, often set to maintain professionalism and respect in various settings.

Course Of Action

A plan or strategy designed to achieve a particular goal or resolve a problem.

Helper's Course

A training program designed to equip individuals with the skills and knowledge necessary to provide assistance or support to others.

Q4: Which of the following statements is FALSE?<br>A)The

Q4: Luther's weighted average cost of capital is

Q5: Which of the following is true of

Q9: Which of the following statements is FALSE?<br>A)When

Q12: Equity in a firm with no debt

Q32: Which of the following equations would NOT

Q37: Construct a binomial tree detailing the option

Q37: Suppose that to raise the funds for

Q39: Aardvark's unlevered cost of equity is closest

Q76: If Flagstaff currently maintains a .5 debt