Use the information for the question(s)below.

KD Industries has 30 million shares outstanding with a market price of $20 per share and no debt. KD has had consistently stable earnings, and pays a 35% tax rate. Management plans to borrow $200 million on a permanent basis through a leveraged recapitalization in which they would use the borrowed funds to repurchase outstanding shares.

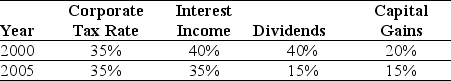

-Assume the following tax schedule:

Personal Tax Rates

Considering the effect of personal taxes, calculate the PV of the interest tax shield provided by KD's recapitalization in 2005.

Considering the effect of personal taxes, calculate the PV of the interest tax shield provided by KD's recapitalization in 2005.

Definitions:

Net Cash Inflow

The amount of cash that flows into a company subtracting the cash that flows out during a specific time period.

Compensating Balance

A minimum account balance that a borrower is required to maintain with a lender, often used to offset the cost of a loan.

Loan Agreement

A contract between a borrower and a lender outlining the terms and conditions of a loan.

Excess Funds

Financial resources that exceed the current needs or obligations of a company or individual, available for investment or other purposes.

Q4: Which of the following statements is FALSE?<br>A)If

Q11: The amount of additional cash that d'Anconia

Q19: An option strategy in which you hold

Q21: Your firm is planning to invest in

Q37: If Wyatt adjusts its debt once per

Q54: Calculate the debt capacity of Omicron's new

Q55: The effective dividend tax rate for an

Q71: Which of the following statements is FALSE?<br>A)Creditors

Q84: With its current leverage, WELS Corporation will

Q117: The Sharpe ratio for your portfolio is