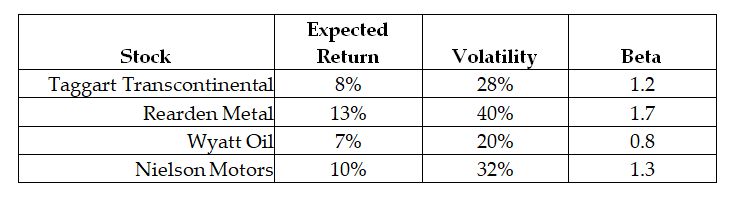

Use the following information to answer the question(s) below.

Assume that the CAPM is a good description of stock price returns. The market expected return is 8% with 12% volatility and the risk-free rate is 3%. New information arrives that does not change any of these numbers, but it does change the expected returns of the following stocks:

-The expected alpha for Wyatt Oil is closest to:

Definitions:

Forest

A large area covered chiefly with trees and undergrowth.

Intense Heat

Extremely high temperatures that can impact the environment, human health, and overall climate patterns.

Primary Succession

The series of community changes which occur on an entirely new habitat which has never been colonized before.

Retreating Glacier

A glacier that is decreasing in size and moving backward over time, often an indicator of climate change.

Q6: Which of the following statements is FALSE?<br>A)The

Q8: Suppose that Rearden Metal made a surprise

Q35: The cost of capital for a project

Q37: Which of the following statements is FALSE?<br>A)The

Q43: A type of agency problem that results

Q48: In practice which market index is most

Q59: The overall asset beta for Wyatt Oil

Q77: Which of the following statements is FALSE?<br>A)In

Q86: Which of the following statements is FALSE?<br>A)A

Q133: Calculate the variance on a portfolio that