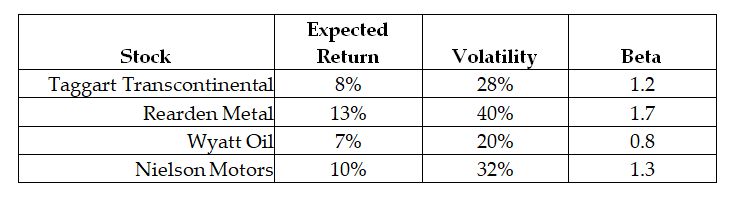

Use the following information to answer the question(s) below.

Assume that the CAPM is a good description of stock price returns. The market expected return is 8% with 12% volatility and the risk-free rate is 3%. New information arrives that does not change any of these numbers, but it does change the expected returns of the following stocks:

-Which of the following stocks represent selling opportunities?

1.Taggart Transcontinental

2.Rearden Metal

3.Wyatt Oil

4.Nielson Motors

Definitions:

Pairs of Shoes

Units of footwear intended to be worn on people's feet, typically sold, bought, or produced in matching sets of two.

Domestic Price

The price of goods or services within a country's borders, unaffected by import or export factors.

Trade Price

The price at which goods or services are traded between parties, often wholesale prices.

Pairs of Shoes

A unit of measure often used in economics or retail to discuss the quantity of shoes, indicative of inventory levels or sales volumes.

Q2: If you want to value a firm

Q21: If in the event of distress, the

Q33: Various trading strategies appear to offer non-zero

Q58: If Luther decides to pay the dividend

Q61: Iota's weighted average cost of capital is

Q71: Consider the following equation: P<sub>cum</sub> - P<sub>ex

Q81: Which of the following statements is FALSE?<br>A)Expected

Q83: What is the standard deviation of Big

Q88: What is the market portfolio?

Q108: If its managers increase the risk of