Use the following information to answer the question(s) below.

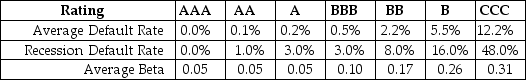

Consider the following information regarding corporate bonds:

-Nielson Motors plans to issue 10-year bonds that it believes will have an BBB rating.Suppose AAA bonds with the same maturity have a 3.5% yield.Assume that the market risk premium is 5% and the expected loss rate in the event of default on the bonds is 60%.The yield that these bonds will have to pay during a recession is closest to:

Definitions:

Legal Obligation

A duty enforced by law, requiring an individual or entity to conform to certain conduct or to refrain from certain actions.

Gratuitous Promise

A promise made without expecting anything in return, which is generally not enforceable in contract law unless it is made in a deed.

Existing Duty

An obligation that is currently in effect under the law or within the terms of a contract.

Consideration

In contract law, something of value promised to another when making an agreement, which is required for the contract to be enforceable.

Q17: Which of the following statements is FALSE?<br>A)As

Q18: Rearden Metal has a bond issue outstanding

Q35: The cost of capital for a project

Q36: Kinston's current share price is closest to:<br>A)$20.40<br>B)$9.40<br>C)$11.00<br>D)$10.00

Q43: Which of the following statements is FALSE?<br>A)Investors

Q48: Assume that in the event of default,

Q56: Which of the following statements is FALSE?<br>A)The

Q70: Which of the following statements is FALSE?<br>A)The

Q77: Rearden Metal has no debt, and maintains

Q97: Which of the following statements is FALSE?<br>A)The