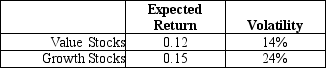

Use the following information to answer the question(s) below.

Suppose that all stocks can be grouped into two mutually exclusive portfolios (with each stock appearing in only one portfolio) : growth stocks and value stocks.Assume that these two portfolios are equal in size (market value) ,the correlation of their returns is equal to 0.6,and the portfolios have the following characteristics:  The risk-free rate is 3.5%.

The risk-free rate is 3.5%.

-The Sharpe ratio for the value stock portfolio is closest to:

Definitions:

Narcissism

A personality trait characterized by an inflated sense of self-importance, a need for excessive attention and admiration, and a lack of empathy for others.

Online Profiles

Digital representations of individuals or organizations on internet platforms, consisting of personal, professional, and social information intended for public or specific audiences.

Autonomy

The capacity and right of individuals to make their own choices and decisions, free from external control or influence.

Texts

Written or printed material regarded as conveying information, ideas, or content.

Q18: The expected return for Rearden Metal is

Q20: Which of the following statements is FALSE?<br>A)The

Q27: The beta for Taggart Transcontinental is closest

Q38: Which of the following statements is FALSE?<br>A)If

Q48: The risk-free rate is closest to:<br>A)0%<br>B)4%<br>C)8%<br>D)16%

Q50: If Flagstaff currently maintains a .5 debt

Q70: Taggart's market capitalization is closest to:<br>A)$25 billion<br>B)$31

Q82: Assume that investors hold Google stock in

Q88: What is the market portfolio?

Q122: The beta of the precious metals fund