Use the following information to answer the question(s) below.

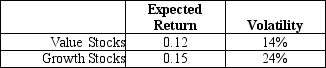

Suppose that all stocks can be grouped into two mutually exclusive portfolios (with each stock appearing in only one portfolio) : growth stocks and value stocks.Assume that these two portfolios are equal in size (market value) ,the correlation of their returns is equal to 0.6,and the portfolios have the following characteristics:  The risk-free rate is 3.5%.

The risk-free rate is 3.5%.

-The expected return on the market portfolio (which is a 50-50 combination of the value and growth portfolios) is closest to:

Definitions:

High Achievers

Persons or entities that consistently exceed standard expectations and goals within their field or activity.

Routine Tasks

Repetitive and predictable tasks that require a standard set of procedures and can be performed with minimal variation.

Motivator Factors

Elements of a job or work environment that can significantly increase employee satisfaction and motivation.

Herzberg's Model

A theory of motivation that distinguishes between hygiene factors (which prevent dissatisfaction) and motivators (which promote job satisfaction and motivation).

Q39: You currently own $100,000 worth of Wal-Mart

Q43: Which of the following equations is INCORRECT?<br>A)Var(R)=

Q52: Assume that capital markets are perfect except

Q56: If its YTM does not change, how

Q60: Which of the following formulas is incorrect?<br>A)Yield

Q61: The Sisyphean Company is considering a new

Q62: Assuming that this bond trades for $1,112,

Q80: Assuming the appropriate YTM on the Sisyphean

Q91: Assuming that Novartis AG (NVS)has an EPS

Q92: The total of Rosewood's net income and