Use the following information to answer the question(s) below.

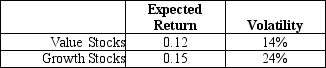

Suppose that all stocks can be grouped into two mutually exclusive portfolios (with each stock appearing in only one portfolio) : growth stocks and value stocks.Assume that these two portfolios are equal in size (market value) ,the correlation of their returns is equal to 0.6,and the portfolios have the following characteristics:  The risk-free rate is 3.5%.

The risk-free rate is 3.5%.

-The volatility on the market portfolio (which is a 50-50 combination of the value and growth portfolios) is closest to:

Definitions:

Q17: Which of the four bonds is the

Q28: The NPV for this project is closest

Q37: Which of the following statements is FALSE?<br>A)The

Q40: Which of the following statements is FALSE?<br>A)Holding

Q51: Which of the following statements is FALSE?<br>A)Because

Q55: The internal rate of return (IRR)for project

Q69: Assume that in addition to 1.25 billion

Q71: Which of the following statements is FALSE?<br>A)Zero-coupon

Q78: Suppose that you borrow $60,000 in financing

Q80: Monsters' beta with the market is closest