Use the following information to answer the question(s) below.

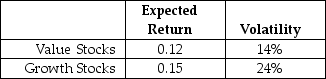

Suppose that all stocks can be grouped into two mutually exclusive portfolios (with each stock appearing in only one portfolio) : growth stocks and value stocks.Assume that these two portfolios are equal in size (market value) ,the correlation of their returns is equal to 0.6,and the portfolios have the following characteristics:  The risk free rate is 3.5%.

The risk free rate is 3.5%.

-Which of the following statements is FALSE?

Definitions:

Biological Process

A series of actions or steps taken by living organisms to sustain life, such as respiration, digestion, and reproduction.

Sign Language

A form of communication using visual gestures and signs, primarily utilized by the deaf and hard of hearing communities.

Deaf Children

Individuals who are unable to hear or have significant hearing loss from birth or early childhood.

Linguistic Determinism

The hypothesis that language limits and determines human thought patterns and knowledge.

Q9: Money that has been or will be

Q12: Which of the following statements is FALSE?<br>A)We

Q54: The excess return if the difference between

Q58: Consider a bond that pays annually an

Q61: Which of the following statements is FALSE?<br>A)The

Q65: The overall value of Wyatt Oil (in

Q67: Which of the following statements is correct?<br>A)You

Q81: At the conclusion of this transaction, the

Q90: If the risk-free rate is 5% and

Q91: The e<sub>i</sub> in the regression<br>A)measures the market