Use the following information to answer the question(s) below.

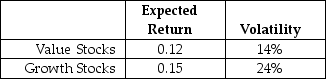

Suppose that all stocks can be grouped into two mutually exclusive portfolios (with each stock appearing in only one portfolio) : growth stocks and value stocks.Assume that these two portfolios are equal in size (market value) ,the correlation of their returns is equal to 0.6,and the portfolios have the following characteristics:  The risk free rate is 3.5%.

The risk free rate is 3.5%.

-The Sharpe ratio for the market (which is a 50-50 combination of the value and growth portfolios) portfolio is closest to:

Definitions:

Q6: Which of the following statements is FALSE?<br>A)The

Q32: The YTM of a 3 year default

Q58: The market value for Bernard is closest

Q64: Suppose you are a shareholder in d'Anconia

Q69: Galt Industries has 125 million shares outstanding

Q70: Assume that your capital is constrained, so

Q70: IF FBNA increases leverage so that its

Q72: Assuming that Casa Grande Farms depreciates these

Q90: The expected return for Nielson Motors stock

Q97: Which of the following statements is FALSE?<br>A)The