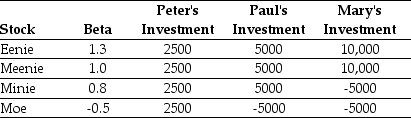

Use the table for the question(s) below.

Consider the following three individuals portfolios consisting of investments in four stocks:

-Assuming that the risk-free rate is 4% and the expected return on the market is 12%,then required return on Peter's Portfolio is closest to:

Definitions:

Standard Deviation

A statistical index that signifies the distribution of data points around the mean of a dataset.

Critical Value

The threshold value that a test statistic must exceed to reject the null hypothesis in a statistical test.

Significance Level

The probability of rejecting the null hypothesis in a statistical test when it is in fact true. It is used to determine the threshold of statistical significance.

Population Variances

A measure of the dispersion or spread of a population's values, calculated as the average of the squared differences from the population mean.

Q9: Consider the following equation: E + D

Q9: The Market's excess return for 2008 is

Q10: What do you anticipate will happen to

Q12: Wyatt oil presently pays no dividend. You

Q46: California Gold Mining's required return is closest

Q57: Portfolio "B":<br>A)is less risky than the market

Q63: The price (expressed as a percentage of

Q75: You want to maximize your expected return

Q78: How much are each of the semiannual

Q92: Assume that the Wilshire 5000 currently has