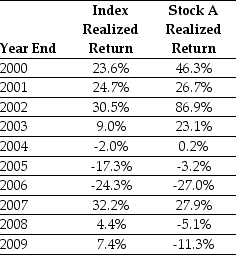

Use the table for the question(s) below.

Consider the following realized annual returns:

-Suppose that you want to use the 10-year historical average return on the Index to forecast the expected future return on the Index.The standard error of your estimate of the expected return is closest to:

Definitions:

Total Earnings

The sum of all income and revenue generated by a business or individual within a specific period.

Shares Outstanding

Refers to all shares currently owned by shareholders, company insiders, and investors in the public domain, representing ownership in a company.

Market Price

The present cost at which an asset or service is offered for buying or selling in the market.

Merged Firm

Refers to a company formed when two or more firms voluntarily combine their operations, often to achieve synergies and improve competitive standing.

Q15: Which of the following statements is FALSE?<br>A)When

Q26: The expected return on security with a

Q38: Which of the following statements is FALSE?<br>A)If

Q48: The NPV profile<br>A)shows the payback period -

Q50: If you are interested in creating a

Q67: The expected overall payoff to Bank B

Q73: Suppose that you want to use the

Q73: The profitability index for project A is

Q80: Which of the following statements is FALSE?<br>A)Because

Q93: Suppose you plan to hold Von Bora