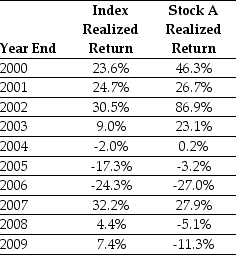

Use the table for the question(s) below.

Consider the following realized annual returns:

-Suppose that you want to use the 10-year historical average return on the Index to forecast the expected future return on the Index.The 95% confidence interval for your estimate of the expect return is closest to:

Definitions:

Normal Distributions

A symmetrical, bell-shaped distribution of data in which most of the data points cluster around a central peak and the probabilities for values further away from the mean taper off equally in both directions.

Mathematical Formulas

A concise way of expressing information symbolically, as in a mathematical or chemical formula.

Frequency Distributions

A way to organize data that shows how often each value occurs.

Normal Distributions

A probability distribution that is symmetric about its mean, showing that near the mean there's a higher likelihood of occurrence, a foundational concept in statistics.

Q10: Which of the following statements is FALSE?<br>A)Securities

Q14: The unlevered beta for Blinkin is closest

Q20: The expected return on the portfolio of

Q25: Which of the following statements is FALSE?<br>A)An

Q30: Which of the following statements is FALSE?<br>A)Once

Q51: If CCM has $200 million of debt

Q64: The term a<sub>s </sub>is a(n):<br>A)error term that

Q65: Suppose that Google Stock has a beta

Q81: The free cash flow for the first

Q93: Bubba Ho-Tep Company reported net income of