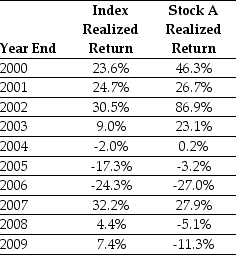

Use the table for the question(s) below.

Consider the following realized annual returns:

-Suppose that you want to use the 10-year historical average return on Stock A to forecast the expected future return on Stock A.The 95% confidence interval for your estimate of the expect return is closest to:

Definitions:

Acid-Test Ratio

A financial metric comparing a company's most liquid assets (excluding inventory) to its current liabilities, used to assess short-term solvency.

Marketable Securities

These are liquid financial instruments that can easily be converted into cash at their current value in the financial markets.

Selling And Administrative Expenses

Expenses related to the selling of products and the management of the business, not directly tied to manufacturing.

Noncurrent Assets

Noncurrent assets are long-term assets not expected to be converted into cash or used up within one year, such as property, plant, and equipment.

Q16: If the Krusty Krab's opportunity cost of

Q30: Which of the following statements is FALSE?<br>A)A

Q40: The change in Net working capital from

Q51: Which of the following statements is FALSE?<br>A)Given

Q63: The lowest effective rate of return you

Q64: Raceway Products has a market debt-to-equity ratio

Q74: Which of the following statements is FALSE?<br>A)Stock

Q82: The internal rate of return (IRR)for project

Q84: Suppose you invest $15,000 in Merck stock

Q98: Galt's asset beta (ie the beta of