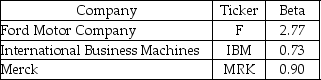

Use the following information to answer the question(s) below.

-If the expected return on the market is 11% and the risk-free rate is 4%,then the expected return of investing in IBM is closest to:

Definitions:

Aggregate-Demand Curve

A graphical representation of the total demand for goods and services within an economy at varying price levels.

Monetary Policy

The process by which the central bank or monetary authority of a country controls the supply of money, often targeting an inflation rate or interest rate to ensure economic stability and growth.

Aggregate Demand

Total need for every type of good and service within an economic system, quantified at a specific price level and during a certain timeline.

Money Supply

The complete volume of monetary resources present in an economy at a specific moment, which comprises cash, coins, and the amounts in checking and savings accounts.

Q8: The credit spread on B-rated corporate bonds

Q10: The NPV for this project is closest

Q11: The number of shares that Galt must

Q12: Which of the following statements is FALSE?<br>A)Firm

Q59: The overall asset beta for Wyatt Oil

Q60: Which of the following statements is FALSE?<br>A)We

Q75: With perfect capital markets, what is the

Q90: If the risk-free rate is 5% and

Q91: The e<sub>i</sub> in the regression<br>A)measures the market

Q98: Which of the following statements is FALSE?<br>A)The