Use the information for the question(s) below.

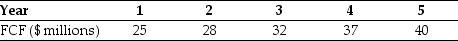

You expect CCM Corporation to generate the following free cash flows over the next five years:  Following year five,you estimate that CCM's free cash flows will grow at 5% per year and that CCM's weighted average cost of capital is 13%.

Following year five,you estimate that CCM's free cash flows will grow at 5% per year and that CCM's weighted average cost of capital is 13%.

-The enterprise value of CCM corporation is closest to:

Definitions:

Palpation

A method used by healthcare providers to feel the body with their hands to examine the size, consistency, texture, location, and tenderness of an organ or body part.

Visual Field

The total area in which objects can be seen in the peripheral vision while the eye is focused on a central point.

Advanced Glaucoma

A severe stage of glaucoma, characterized by significant vision loss due to damage to the optic nerve.

Peripheral Vascular Disease

A circulatory condition in which narrowed blood vessels reduce blood flow to the limbs.

Q5: Wyatt Oil just reported that a major

Q14: Suppose that you have invested $30,000 in

Q26: Assuming that Dewey's cost of capital is

Q35: Which of the following statements is FALSE?<br>A)Bonds

Q38: Which of the following statements is FALSE?<br>A)The

Q57: Which of the following statements is FALSE?<br>A)The

Q62: Your son is about to start kindergarten

Q67: The risk premium for "Meenie" is closest

Q73: What is a sunk cost? Should it

Q91: Assuming that Novartis AG (NVS)has an EPS