Use the information for the question(s) below.

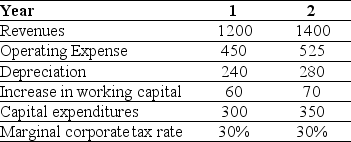

Shepard Industries is evaluating a proposal to expand its current distribution facilities. Management has projected the project will produce the following cash flows for the first two years (in millions) .

-The incremental EBIT for Shepard Industries in year one is closest to:

Definitions:

Direct Write-off Method

An accounting practice where uncollectible accounts receivable are directly written off against income at the time they are deemed uncollectible.

Uncollectible Receivables

Debts owed to a company that are considered impossible or highly unlikely to be paid, often written off as bad debt.

Bad Debt Expense

An estimated expense that represents the amount of receivables that a company does not expect to collect due to customers' inability to pay.

Allowance for Doubtful Accounts

An estimation of the amount of accounts receivable that may not be collectible, serving as a contra asset account.

Q6: You are offered an investment opportunity that

Q19: The amount of money that your great

Q20: Taggart Transcontinental has a divided yield of

Q20: The expected return on the portfolio of

Q33: Suppose a risky security pays an average

Q33: What is the shape of the yield

Q50: Which of the following formulas is INCORRECT?<br>A)g

Q58: Firms should adjust for execution risk by:<br>A)assigning

Q58: The payback period for Rearden's mining operation

Q96: Which of the following statements is FALSE?<br>A)Because