Use the information for the question(s) below.

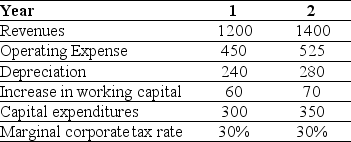

Shepard Industries is evaluating a proposal to expand its current distribution facilities. Management has projected the project will produce the following cash flows for the first two years (in millions) .

-The depreciation tax shield for Shepard Industries project in year one is closest to:

Definitions:

Nominal Face Value

The stated value of a financial instrument (e.g., bond) at issuance, unrelated to market value.

Zero Coupon Bond

A debt security that doesn't pay interest but is traded at a deep discount, offering a profit at maturity when the bond is redeemed for its full face value.

Face Value

The nominal value stated on a financial instrument, such as a bond or stock, representing its worth at issuance or maturity.

Market Value

The current price at which an asset or service can be bought or sold in the open market.

Q1: Assume that your capital is constrained, so

Q2: You are considering investing $600,000 in a

Q17: Which of the following statements is FALSE?<br>A)As

Q27: Which of the following statements is FALSE?<br>A)Financial

Q45: The weight on Lowes in your portfolio

Q48: Using the FFC four factor model and

Q61: The future value at retirement (age 65)of

Q85: If the appropriate discount rate for this

Q88: Assume that the ETF is trading for

Q98: Which of the following statements is FALSE?<br>A)Fluctuations