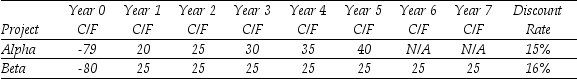

Use the table for the question(s) below.

Consider the following two projects with cash flows in $:

-The internal rate of return (IRR) for project Beta is closest to:

Definitions:

Cash Flows

The entire sum of money flowing in and out of an enterprise, notably affecting its ability to meet short-term obligations.

IRR

Internal Rate of Return; a financial metric used to estimate the profitability of potential investments.

Cost of Capital

The rate of return a firm needs to generate on its investment initiatives to preserve its market value and appeal to investors.

Cash Flows

The combined total of cash inflows and outflows in a company, significantly impacting its liquid assets.

Q9: The Volatility on Stock Y's returns is

Q27: You expect KT Industries (KTI)will have earnings

Q32: Suppose Novak Company experienced a reduction in

Q38: Draw a timeline detailing the cash flows

Q41: In terms of present value, how much

Q51: Suppose that a security with a risk-free

Q54: In the US the Sarbanes-Oxley Act (SOX)was

Q63: Which of the following statements is FALSE?<br>A)Without

Q75: Which of the following statements is FALSE?<br>A)Most

Q93: Which of the following statements is FALSE?<br>A)In