Use the table for the question(s)below.

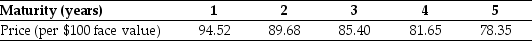

The following table summarizes prices of various default-free zero-coupon bonds (expressed as a percentage of face value):

-Compute the yield to maturity for each of the five zero-coupon bonds.

Definitions:

Embedded Debt Cost

The implicit interest cost contained within a leasing agreement, reflecting the leasing company's financing charges.

Cost of Equity

The return that investors expect for investing in a company's equity, representing the compensation for risk.

Dividend Payment

A portion of a company's profits distributed to shareholders, typically on a quarterly basis.

Q4: If you take the $2,500 rebate and

Q5: Which of the following statements is FALSE?<br>A)Because

Q11: Which of the following is NOT a

Q11: The profitability index for project B is

Q49: What is the excess return for corporate

Q64: Suppose that of the 60% of FFL's

Q73: Which of the following statements is FALSE?<br>A)When

Q81: Assuming that Luther has no convertible bonds

Q93: Which of the following statements is FALSE?<br>A)The

Q96: Which of the following statements is FALSE?<br>A)Because