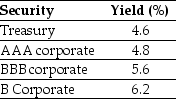

Use the table for the question(s) below.

Consider the following yields to maturity on various one-year zero-coupon securities:

-The price (expressed as a percentage of the face value) of a one-year,zero-coupon corporate bond with a BBB rating is closest to:

Definitions:

Chaparral

A biome characterized by dense, evergreen shrubbery found in areas with hot, dry summers and mild, wet winters, primarily in the southwestern United States.

Bison

Large, grass-eating mammals found primarily in North America, known for their large size, shaggy hair, and horns.

Temperate Grassland

A biome characterized by wide-open spaces with grasses as the dominant vegetation, experiencing moderate rainfall and distinct seasonal temperature variations.

Sagebrush

A type of shrub native to North America, known for its aromatic leaves and adapted to dry, arid conditions, commonly found in desert and steppe environments.

Q35: The free cash flow from Shepard Industries

Q37: Do corporate decisions that increase the value

Q38: Which of these bonds sells at a

Q39: You currently own $100,000 worth of Wal-Mart

Q42: Cash is a:<br>A)non-current asset.<br>B)current asset.<br>C)current liability.<br>D)non-current (long-term)liability.

Q48: The amount that the price of bond

Q50: Which of the following formulas is INCORRECT?<br>A)g

Q62: The NPV for project beta is closest

Q63: If in 2012 Luther has 10.2 million

Q89: Which of the following investments offered the