Use the following information to answer the question(s) below.

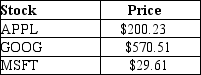

An exchange traded fund (ETF) is a security that represents a portfolio of individual stocks.Consider an ETF for which each share represents a portfolio of two shares of Apple Inc.(APPL) ,one share of Google (GOOG) ,and ten shares of Microsoft (MSFT) .Suppose the current stock prices of each individual stock are as shown below:

-The price per share of this ETF in a normal market is closest to:

Definitions:

Significance Level

The probability of rejecting the null hypothesis in a statistical test when it is actually true, often denoted by alpha (α).

Normally Distributed

Describes a continuous variable whose probabilities are symmetrically distributed around the mean, forming a bell-shaped curve known as the normal distribution.

Duration

A measure of the sensitivity of the price of a bond or other debt instrument to changes in interest rates.

Unbiased Estimator

A statistic that accurately estimates the true parameter of a population, meaning its expected value equals the parameter being estimated.

Q1: Luther Corporation's stock price is $39 and

Q30: The British government has a consol bond

Q33: Ignoring the original investment of $5 million,

Q50: From a bond issuer's perspective, the IRR

Q61: Assuming that you have made all of

Q62: Assuming that this bond trades for $1,112,

Q88: The amount of money that would be

Q117: A firm may face increases in the

Q134: Nico owns 100 shares of stock X

Q165: An investment advisor has recommended a $50,000