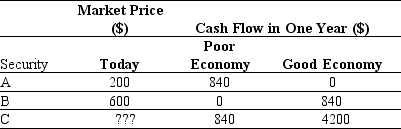

Use the table for the question(s) below.

-Suppose a risky security pays an average cash flow of $100 in one year.The risk-free rate is 5%,and the expected return on the market index is 13%.If the returns on this security are high when the economy is strong and low when the economy is weak,but the returns vary by only half as much as the market index,then the price for this risky security is closest to:

Definitions:

Parenthood

The state or role of being a parent, involving the responsibilities of caring for and raising children.

Certain Age

A specific period in life that is often associated with particular rights, responsibilities, or developmental milestones.

Accrued Expenses

All unpaid financial obligations incurred by an organization.

Q7: The amount of preferred stock dividends that

Q10: The highest effective rate of return you

Q29: The total amount of interest that Dagny

Q30: On the balance sheet, current maturities of

Q47: The credit spread on AAA-rated corporate bonds

Q58: Consider a bond that pays annually an

Q74: Which of the following statements regarding annuities

Q80: Which of the following statements is correct?<br>A)You

Q102: A 4 year default free security with

Q164: Although preferred stock provides added financial leverage