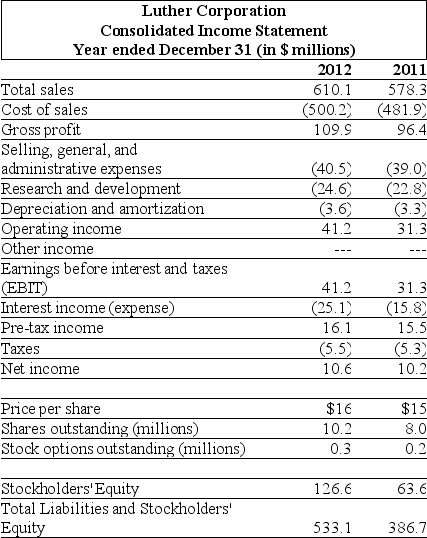

Use the table for the question(s) below.

Consider the following income statement and other information:

-Luther's return on assets (ROA) for the year ending December 31, 2012 is closest to:

Definitions:

Expected Value

The weighted average of all possible values of a random variable, with the weights being the probabilities of the outcomes.

Portfolio

A blend of financial contributions, featuring stocks, bonds, market commodities, ready money, and equivalents of cash, comprising also mutual funds and ETFs.

Stocks

Shares of ownership in a corporation or financial asset, which represent a claim on the company's earnings and assets.

Investment

Allocation of resources, such as time, money, or effort, in the expectation of generating a future benefit or return.

Q34: Consider the following timeline: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2790/.jpg" alt="Consider

Q52: The inventory days ratio measures:<br>A)the average length

Q59: Which of the following statements regarding the

Q71: The inclusion of assets from countries that

Q79: Flotation costs reduce the net proceeds from

Q94: _ is hired by a firm to

Q97: Small business investment companies (SBICs) are corporations

Q105: An increase in nondiversifiable risk<br>A) would cause

Q128: In the case of liquidation, common stockholders

Q165: A proxy statement is<br>A) a statement giving