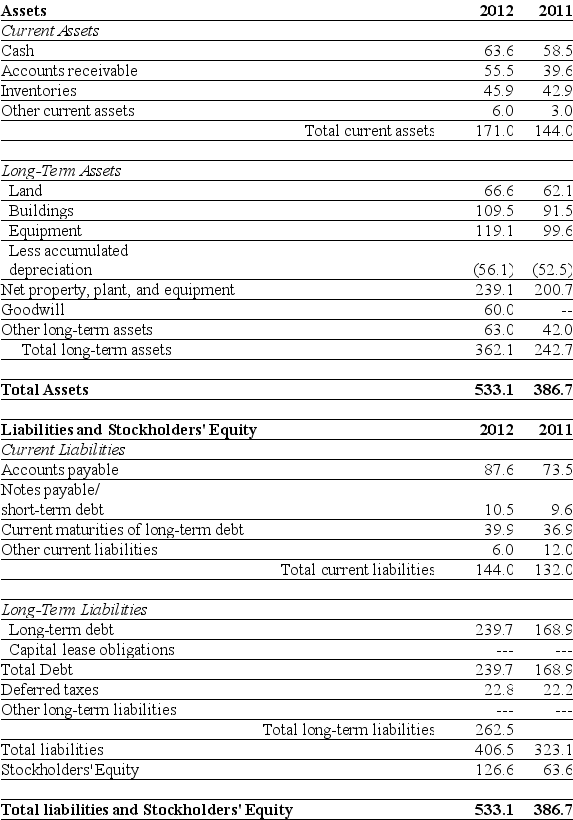

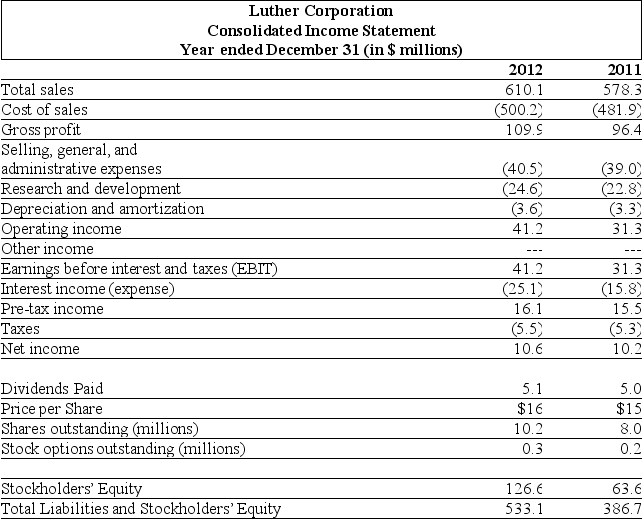

Use the tables for the question(s)below.

Consider the following financial information:

-For the year ending December 31, 2012 Luther's cash flow from financing activities is:

Definitions:

Taste Sensitivity

The ability to detect and differentiate the flavors and tastes of various substances.

Supertasters

Individuals with a heightened sense of taste, particularly sensitive to bitter compounds.

Gender Gap

The disparities between males and females, often referring to differences in pay, employment opportunities, political representation, or health outcomes.

Descending Neural Pathway

Neural tracts that carry motor signals from the brain down the spinal cord to the muscles to initiate movement.

Q25: The risk of a portfolio containing international

Q25: Assume the appropriate discount rate for this

Q25: Which of the following adjustments to net

Q30: An increase in the Treasury Bill rate

Q36: If you were to create a portfolio

Q60: From a bond issuer's perspective, the IRR

Q69: The preferred capital structure weights to be

Q75: Given the following expected returns and standard

Q76: A firm has determined its cost of

Q80: Firms occasionally repurchase stock in order to